Z Turing’s e-Wallet Synopsis

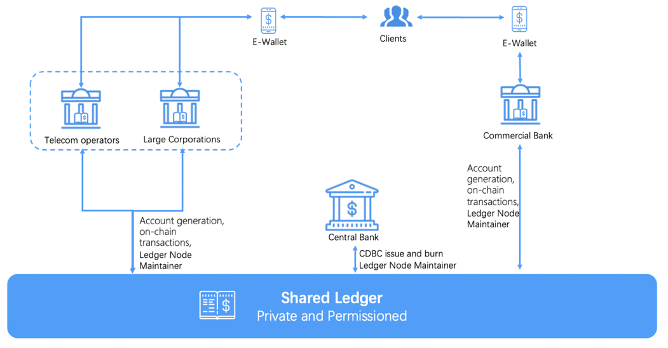

why e-wallet on the blockchain, how to implement, how to work with Telecommunication providers and banks

Blockchain technology bring unique advantages to a CBDC

1. Basis of Trust — A blockchain-based CBDC enables central banks to control the currency while protecting the privacy and independence of the CBDC’s use to the end-users. We believe users mustn’t be locked in by intermediaries to trust and use the CBDC

2. Programmability — CBDC rules can be hard-coded in the protocol to facilitate compliance, i.e., valid digital identity as a condition for the transaction

3. Data Availability — Distributed systems such as blockchains ensure data availability and resilience, in addition to trust and transparency around transaction history. Ethereum has proven its ability to support an extensive network of millions of users. And the consensus algorithm that we create makes the energy consumption extremely low and can support more users

4. Innovation — A blockchain-based CBDC benefits from the innovative products and services that are being built across the open-source blockchain ecosystem, including non-custodial wallets, zero-knowledge cryptography, and decentralized finance. For example, Ethereum is the world’s largest blockchain ecosystem, and more than 350,000 developers are contributing to code

El Salvador has adopted Bitcoin as a legal tender. As of 2021, we estimated global crypto ownership rates at an average of 2.8%, with 200 million crypto users worldwide. If we adopt blockchain as the underlying technology of CDBC, the e-wallet based on this will be able to seamlessly provide users with all legally recognized crypto custody and non-custodial services, as well as corresponding digital banking services in the future.